𝗣𝗮𝗿𝘁 𝟰 — 𝗧𝗵𝗲 𝗘𝗰𝗼𝗻𝗼𝗺𝗶𝗰 𝗙𝗮𝗶𝗹𝘂𝗿𝗲𝘀 𝗼𝗳 𝗗𝗲𝗺𝗮𝗻𝗱-𝗦𝗶𝗱𝗲 𝗣𝗼𝗽𝘂𝗹𝗮𝘁𝗶𝗼𝗻 𝗛𝗲𝗮𝗹𝘁𝗵

Executives don’t need to be told that costs are rising. They feel it every quarter when MLR runs hot, when Stars bonuses shrink, and when reserves are eaten by unplanned utilization.

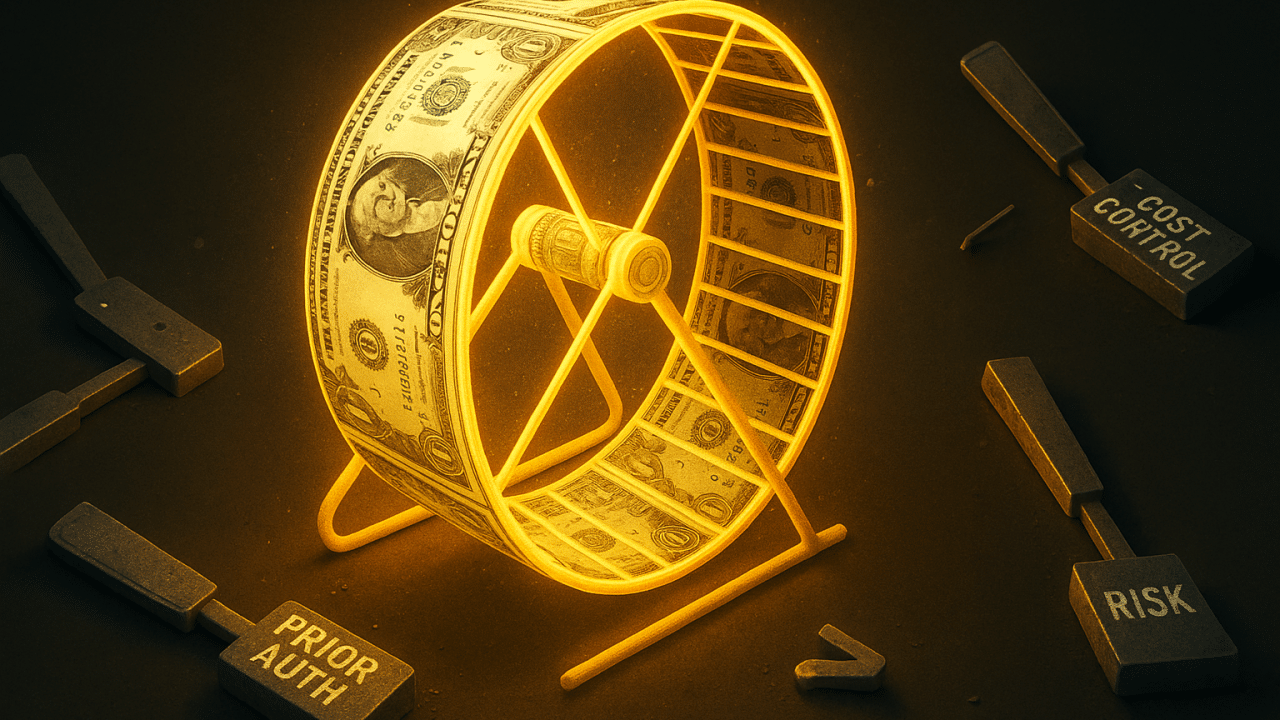

The deeper pain is that every lever that was supposed to fix population health economics has failed. Utilization suppression. Gap closure. Risk adjustment. Even pricing. Each lever created short-term optics, not long-term stability. And every time a lever ran out, a new hamster wheel was spun up, costing more, delivering less.

𝗨𝘁𝗶𝗹𝗶𝘇𝗮𝘁𝗶𝗼𝗻 𝗦𝘂𝗽𝗽𝗿𝗲𝘀𝘀𝗶𝗼𝗻: 𝗧𝗵𝗲 𝗕𝗮𝗰𝗸𝗳𝗶𝗿𝗲 𝗘𝘃𝗲𝗿𝘆𝗼𝗻𝗲 𝗦𝗮𝘄 𝗖𝗼𝗺𝗶𝗻𝗴

The first instinct of every payer has been to suppress demand. Narrow the network. Tighten prior authorization. Raise deductibles. Deny the claim.

For a quarter or two, the numbers look better. But by the next fiscal year, the liabilities arrive.

Deferred care returns with higher acuity. A skipped MRI becomes a $150,000 late-stage cancer admission.

Provider abrasion explodes. Networks destabilize. Appeals eat administrative time. Regulators intervene.

Members get angry. Churn increases. Plans take reputational hits they can’t price their way out of.

This is why cost containment always feels like running downhill, fast gains, hard crashes. CFOs know the pattern because they’ve watched “savings” evaporate into spikes in avoidable ER visits and readmissions. Utilization suppression doesn’t bend the cost curve. It defers the bill and compounds the interest.

𝗚𝗮𝗽 𝗖𝗹𝗼𝘀𝘂𝗿𝗲: 𝗧𝗵𝗲 𝗣𝗲𝗿𝗽𝗲𝘁𝘂𝗮𝗹 𝗛𝗮𝗺𝘀𝘁𝗲𝗿 𝗪𝗵𝗲𝗲𝗹

Next came care gap closure.

The ACA’s Stars system made gap closure the golden ticket to Quality Bonus Payments. Entire departments and vendor ecosystems were built to track, chase, and close gaps. At first, the economics looked promising. Then reality hit.

Every gap reopens annually. Diabetic eye exams, A1c tests, mammograms, none are permanent. Plans pay the same outreach cost every year for the same member.

Outreach ROI is dismal. Member response rates in many MA populations are below 20%, even with multiple touchpoints.

Case managers are overloaded. Burnout is high. Vendors promise “engagement lift” that rarely translates to score lift.

And when CMS raised Stars cut points in 2025, ratings collapsed. Only 40% of contracts hit 4+ Stars, down from nearly 70% just three years earlier.

Billions spent. Infrastructure built. But when the rules changed, the scaffolding collapsed. This is the definition of treadmill economics: huge effort, no forward movement.

𝗔𝗱𝗺𝗶𝗻𝗶𝘀𝘁𝗿𝗮𝘁𝗶𝘃𝗲 𝗪𝗮𝘀𝘁𝗲: 𝗧𝗵𝗲 𝗣𝗲𝗿𝗺𝗮𝗻𝗲𝗻𝘁 𝗧𝗮𝘅 𝗼𝗳 𝗗𝗲𝗺𝗮𝗻𝗱-𝗦𝗶𝗱𝗲 𝗧𝗵𝗶𝗻𝗸𝗶𝗻𝗴

The ACA’s MLR rule institutionalized administrative overhead. Plans had to pour money into “quality improvement” projects, which translated into armies of staff, consultants, and vendors.

Commercial insurers now spend 12–15% on administration versus Medicare’s ~2%.

Stars and risk departments are larger than some clinical divisions.

Entire industries sprang up around HEDIS, CAHPS, adherence, and risk adjustment, siphoning billions without addressing root cost drivers.

This is a structural tax on the system. Every health plan CFO knows their administrative cost ratio is bloated, but none can shrink it without threatening compliance. Demand-side economics has made overhead non-negotiable.

𝗣𝗿𝗶𝗰𝗶𝗻𝗴 𝗣𝗼𝘄𝗲𝗿: 𝗧𝗵𝗲 𝗟𝗮𝘀𝘁 𝗟𝗲𝘃𝗲𝗿, 𝗡𝗼𝘄 𝗘𝘅𝗵𝗮𝘂𝘀𝘁𝗲𝗱

When utilization suppression, gap closure, and admin bloat failed, plans leaned on pricing.

Medicare Advantage: aggressive bidding strategies bought membership growth, but now benchmarks are tightening and medical costs are outpacing bid assumptions.

Medicaid managed care: HBR caps are limiting profitability. States are demanding better outcomes with less flexibility.

Commercial lines: employers are pushing back on premium increases and regulators are watching network adequacy closely.

The pricing lever is gone. Health plans can’t underbid their way out of operational failure anymore. They’ve reached the floor.

𝗧𝗵𝗲 𝗣𝗮𝗶𝗻 𝗼𝗻 𝘁𝗵𝗲 𝗚𝗿𝗼𝘂𝗻𝗱

Executives don’t need more charts to tell them what they already know:

Margins in MA are shrinking even after record spend on Stars and risk infrastructure.

Medicaid MCOs are hitting HBR caps while high-risk members remain unmanaged.

Admin cost structures are locked in and only getting heavier.

Members are angrier, sicker, and more expensive despite “engagement” programs.

This isn’t bad luck. It’s the inevitable outcome of demand-side economics. Suppress. React. Score. Repeat. The more plans run, the more they bleed.

𝗧𝗵𝗲 𝗕𝗼𝘁𝘁𝗼𝗺 𝗟𝗶𝗻𝗲

The industry is at a breaking point because every lever has been pulled and every wheel has been spun. Utilization suppression backfires. Gap closure doesn’t scale. Administrative spend is locked in. Pricing power is gone.

Demand-side economics has delivered exactly what it was designed to: activity without progress. It has not, and cannot, deliver durable margins.